The Effect of Economic Growth and Inflation on the Composite Stock Price Index for the Period 2020-2023

Main Article Content

Wahyu Indah Mursalini*

Nurhayati

Raihan Najid

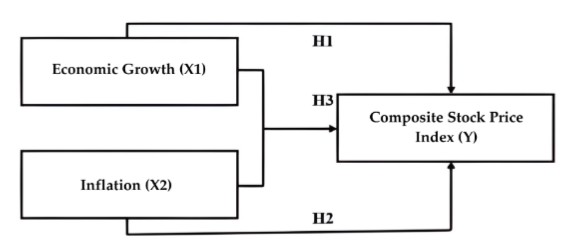

This investigation aspires to procure empirical substantiation concerning the repercussion of economic expansion and inflation upon the Composite Stock Price Index (IHSG) on the Indonesia Stock Exchange (IDX) throughout the span of 2020–2023. The methodological framework employed is regression analysis within a quantitative paradigm, grounded in archival data of IHSG reports. The research cohort was delineated through a total sampling technique, yielding 48 monthly observations consonant with the stipulated criteria.The findings disclose that economic expansion exerts a constructive and statistically momentous influence on the IHSG, evidenced by a t-statistic of 12.638 surpassing the critical threshold of 2.01410, with a probability value of 0.000 < 0.05. Accordingly, hypothesis (H1) is corroborated while the null proposition is repudiated. In contraposition, inflation likewise manifests a significant effect on the IHSG, with a t-statistic of 12,905.184 > 2.01410 and a probability value of 0.003 < 0.05, thereby validating hypothesis (H2).Conjointly, economic expansion and inflation were discerned to wield a simultaneous and notable effect on the IHSG, with an F-statistic of 121.218 exceeding the tabular benchmark of 3.204 and a significance level of 0.000 < 0.05, affirming hypothesis (H3). Thus, the inquiry elucidates that economic expansion assumes a pivotal role in augmenting the IHSG, while inflation also imparts a consequential individual impact. Nevertheless, under a joint analytical lens, both determinants conjointly demonstrate a substantive influence upon the trajectory of the IHSG.

Akbar, F. (2022). Pengaruh Faktor-Faktor Makro Ekonomi Terhadap Indonesia ( BEI ) Periode 2018-2022 Jurnal Manajemen Bisnis Eka Prasetya. 10(1), 156–164.

Arafat. A, L., Meta, W., & Meilisa, M. (2024). Comparison of Vector Autoregressive (VAR) and Vector Error Correction Models (VECM) for the Composite Stock Price Index (JCI) in Indonesia. Transekonomika: Akuntansi, Bisnis Dan Keuangan, 4(6), 1011–1025. https://doi.org/10.55047/transekonomika.v4i6.754

Diaz, E. M., Cunado, J., & de Gracia, F. P. (2024). Global drivers of inflation: The role of supply chain disruptions and commodity price shocks. Economic Modelling, 140, 106860.

Ivic, M. M. (2015). Economic growth and development. Journal of Process Management–New Technologies, International, 3(1), 55–62.

Khan, N., & Naushad, M. (2020). Inflation relationship with the economic growth of the world economy. Available at SSRN 3542729.

Liman, S., Gisela, S., & Delvin, D. (2024). Peran Inflasi Dalam Memoderasi Makro Ekonomi Terhadap Indeks Harga Saham Gabungan (IHSG). Owner, 8(3), 2028–2040. https://doi.org/10.33395/owner.v8i3.2225

McKinnon, R. I. (1988). Monetary and exchange rate policies for international financial stability: a proposal. Journal of Economic Perspectives, 2(1), 83–103.

Mulyo, W. Ci., Hermawan, H., Solekha, R. A., & Sain, Z. H. (2024). Equitable Development as a Form of Economic Equality in Indonesia. International Conference on Islamic Economics (ICIE), 1, 15–22.

Ofika, T. O., Supheni, I., & Rahayu, D. P. (2025). The Role of Inflation, SBI Interest Rates, and The Dollar Exchange Rate In Influencing The Composite Stock Price Index (IHSG) Study In 2020-2023. Proceeding Kilisuci International Conference on Economic & Business, 3.

Salim, A., & Fadilla. (2021). Pengaruh Inflasi Terhadap Pertumbuhan Ekonomi Indonesia Anggun Purnamasari. Ekonomica Sharia: Jurnal Pemikiran Dan Pengembangan Ekonomi Syariah, 7(1), 17–28.

Silalahi, E., & Sihombing, R. (2021). Pengaruh Faktor Makro Ekonomi Terhadap Pergerakan Indeks Harga Saham Gabungan (Ihsg) Di Bursa Efek Indonesia Periode 2017-2020. Jurnal Riset Akuntansi & Keuangan, 7(2), 139–152. https://doi.org/10.54367/jrak.v7i2.1361

Sim, Y. M., & Kaluge, D. (2023). Examining the Correlation between Macroeconomic Factors and Stock Indices: A Comparative Analysis of IHSG and Nikkei. EkBis: Jurnal Ekonomi Dan Bisnis, 7(2), 126–139.

Suryani, L., & Sudarsono, A. S. P. (2024). Pengaruh Inflasi Dan Pertumbuhan Ekonomi Terhadap Penerimaan Pajak Di Indonesia. Jurnal Akuntansi Keuangan Dan Bisnis, 2(2), 329–334. https://jurnal.ittc.web.id/index.php/jakbs/article/view/1416

Sutandi, Wibowo, S., Sutisna, N., Fung, T. S., & Januardi, L. (2020). Pengaruh Inflasi, Nilai Tukar Rupiah dan Tingkat Suku Bunga Terhadap Indeks Harga Saham Gabungan (IHSG) Di Bursa Efek Indonesia (BEI) Periode 2014-2018. Pengaruh Inflasi, Nilai Tukar Rupiah Dan Tingkat Suku Bunga Terhadap Indeks Harga Saham Gabungan (IHSG) Di Bursa Efek Indonesia (BEI) Periode 2014-2018, 2, 13.

Tarigan, D. R., Ginting, R. O., Situmorang, E. J. Y., Kemala, P., & Lubis, D. (2025). Analisis Pengaruh Inflasi, Suku Bunga dan Nilai Tukar Terhadap Pergerakan Indeks Harga Saham Gabungan (IHSG) di Bursa Efek Indonesia Tahun 2009-2023. BIMA: Journal of Business Inflation Management and Accounting, 2(2), 413–421. https://doi.org/10.57235/bima.v2i2.5792