Sensitivity Analysis of Revenue Potential in The Evaluation of East Surabaya Hospital Investment

Main Article Content

Arianti Widi Astasari*

Wateno Oetomo

Sajiyo

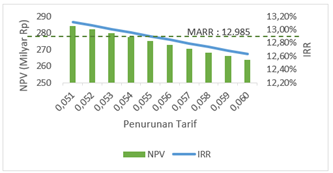

As one of the largest cities in Indonesia, the City of Surabaya has an obligation to provide excellent health services for its residents. It goes without saying that Surabaya City Government is required to provide a General Hospital that can receive referrals from the government-owned Community Health Centers. For this reason, the Surabaya City Government built the East Surabaya Hospital which is located in Rungkut Sub-District. East Surabaya Hospital is a strategic project that requires investment feasibility analysis. The East Surabaya Hospital investment feasibility analysis was done by applying the Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period (PP) and Benefit Cost Ratio (BCR) parameters. After the feasibility analysis results were obtained, a sensitivity analysis was done on changes in management costs and the amount of health service levy rates for each Fees alternative. Based on the results of the investment feasibility analysis of 4 (four) Fees alternatives, there are 2 alternatives that can be concluded as worthy investments, which are alternative 1 and alternative 3. Meanwhile, alternative 2 and alternative 4 are not feasible since the NPV parameter shows negative values and the IRR value is lower than the MARR value. However, based on sensitivity analysis, alternatives 2 and 4 can be feasible if alternative 2’s service rate is increased by 13.2%, and alternative 4’s service rate is increased by 2.3%. The opposite applies in alternative 1 where the investment might become unfeasible if the service rate is reduced by more than 5.4% and alternative 3 might become unfeasible if the service rate is reduced by more than 2.5%.

Abdurrabby, J. (2019). Prosiding Teknik Pertambangan Analisis Sensitivitas Net Present Value (NPV) terhadap Perubahan Parameter Harga Jual dan Biaya Produksi pada Penambangan Tras di CV An-Nakhl Desa Cupang Kecamatan Gempol Kabupaten Cirebon Provinsi Jawa Barat. https://doi.org/10.29313/pertambangan.v6i2.23826

Agni, M. K. (2022). Analisis Investasi Studi Kelayakan Rencana Pengembangan Layanan Rawat Inap Dan Rawat Jalan Rumah Sakit. Jurnal Formil (Forum Ilmiah) Kesmas Respati, 7(3). https://doi.org/10.35842/formil.v7i3.448

Djuhatmoko, N., Purwanto, W., & Tjahjono, A. (2019). Analisis Investasi Pengadaan Alat Radioterapi (Linear Accelerator) Dengan Metoda Net Present Value, Payback Period Dan Internal Rate Of Return Di Rumah Sakit Umum Pusat Dr. Sardjito Yogyakarta. STIE Widya Wiwaha.

Giatman, M. (2006). Ekonomi Teknik, Jakarta: PT. Raja Grafindo Persada.

Hidayat, A. F., Kurniawan, H., & Widyasari, R. (2021). Analisis Kelayakan Finansial Agroindustri Kerupuk Kulit Menggunakan Mesin Peniris di Kecamatan Selong, Kabupaten Lombok Timur. Agroteknika, 4(1), 11–19. https://doi.org/10.32530/agroteknika.v4i1.75

Khairani, D. U., Andreas, A., & Nur Arini, R. (2023). Analisis Kelayakan Investasi Pengembangan Bisnis Konstruksi Dengan Pendekatan Life Cycle Construction. Jurnal ARTESIS, 3(1). https://doi.org/10.35814/artesis.v3i1.5032

Nathanael, R. A., & Indryani, R. (2023). Analisis Sensitivitas Kelayakan Finansial The Bay Apartment Bandar Lampung. Jurnal Teknik ITS, 12(1), C21–C28.

Tenawaheng, P. P. R., Utomo, C., & Wiguna, I. P. A. (2021). Analisis sensitivitas investasi apartemen begawan. Jurnal Teknik ITS, 10(1), D25–D30.

Yan, R., & Zhang, Y. (2022). The Introduction of NPV and IRR. Proceedings of the 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), 648. https://doi.org/10.2991/aebmr.k.220307.241

Yusup, F. (2018). Uji validitas dan reliabilitas instrumen penelitian kuantitatif. Tarbiyah: Jurnal Ilmiah Kependidikan, 7(1).